(Previous Topic: Adding Tip Wage Items in QuickBooks

Setting Up Tip Handling in POSQBi

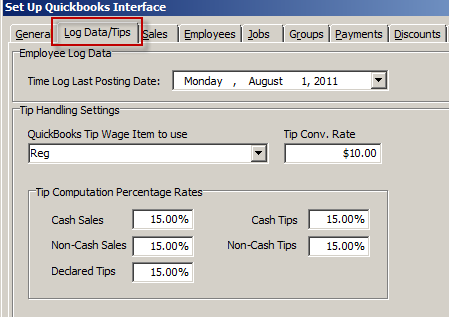

The handling of tips is performed under the Log Data/Tips Tab within the Setup Forms. Since, as of writing, QuickBooks has not yet provided a way of sending tips as an exact amount, the interface (POSQBi) would do this by converting the tip amount as a time entry on the employee time sheet. Thus, the following need to be set-up:

QuickBooks Tip Wage Item to use – The name of the payroll wage item in QuickBooks to differ the tip entry against the normal login data in the time sheet. This is information is configurable Tip Handling Settings of the Log Data/Tips tab in the POSQBi Setup Forms. If there is no wage item listed, see Adding Tip Wage Item in QuickBooks.

- Tip Conv. Rate – Use the conversion rate to converting the tip amount into a time entry. For example, if the tip amount is $100.00 for an employee with a conversion rate of $10.00 (entered in field), it will be sent to QuickBooks as an entry in the employee time sheet as work done for 10 hours.

- Tip Computation Percentage Rates Because of the differing laws from state to state with regards to reporting tips, the interface (POSQBi) was designed to be flexible in handling differing scenarios. The following options allows the user to set-up the as to how much of the tips are to be sent to QuickBooks for payroll computation:

Cash Sales –the percentage rate based from the gross cash sales (revenues) of the employee, inclusive of taxes.

Non-Cash Sales– the percentage rate based from the non-cash sales (revenues) of the employees. Check your local laws as to what percentage of the non-cash sales is to be declared also as an earned income (as tip) of the employee.

Declared Tips – the percentage based from the real tip as declared by the employee.

Cash Tips – the percentage based from the tip amount as recorded from all the cash sales for the employee.

Non-Cash Tips– the percentage based from the tips as recorded from al the non-cash sales for the employee.

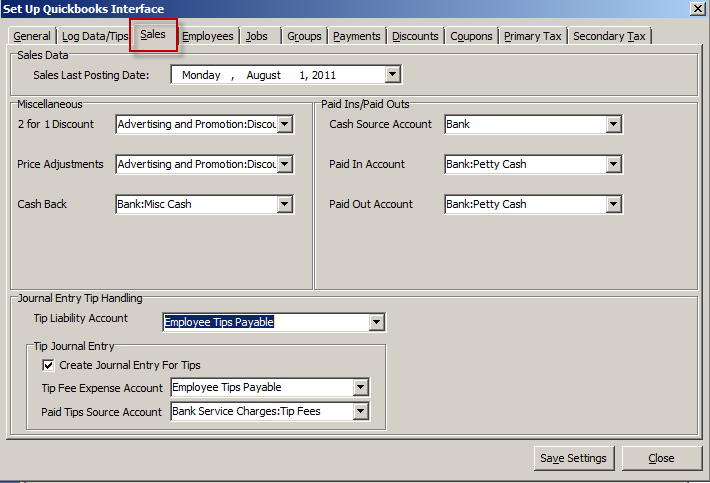

Journal Entry Tip Handling

The interface (POSQBi) could be set-up to create a paid tip journal entry in QuickBooks. Paid tips refer to the amount paid to the employee at the end of the shift including tips from credit card, check or charge sales.

Tip Liability Account – the assigned account that corresponds to the QuickBooks account being set-up to handle paid tips. Before the tip is actually given to the employee, it is being treated as a liability of the restaurant to the employee.

Create Journal Entry For Tips - if checked, the interface (POSQBi) to create journal entry lines for tips received from the customer and paid to the employee.

If the restaurant does receive tips and pay them to the employee (i.e. in fine dining places), it is highly recommended that this be checked. If not (i.e. in fast food places) where tips are not the norm and then leave this unchecked.

If you have this option checked, accounts must be assigned to the following items:

Paid Tips Source Account – the assigned account that corresponds to the where the amount of the tip paid to the employee is actually to be taken out from. Usually, the account to be assigned is of Asset/Bank type.

Tip Fee Expense Account – the assigned account that corresponds to the account is used by the restaurant in recording tip fee expenses/charges. In the interface (POSQBi), this will be entered as a negative debit.

(Next Topic: Adding Employees To QuickBooks)

.